Aruba’s financial side is delicate, but its recovery potential is also visible. The pre-COVID era was not easy as public finances were very fragile due to the large amount of debts that were created.

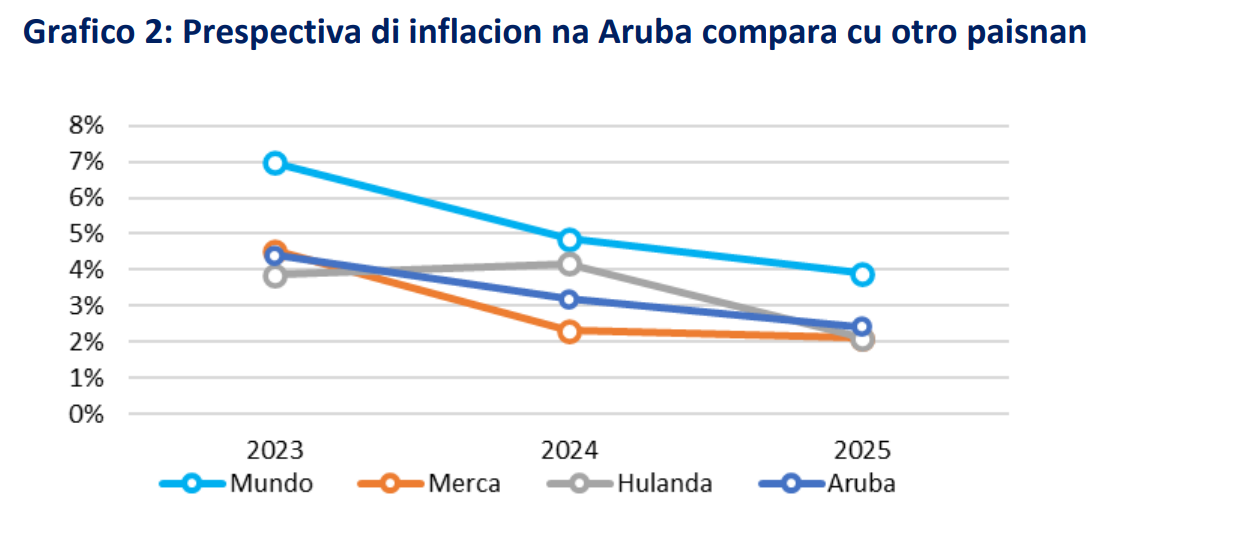

However, with the introduction of COVID the situation has not improved but has become much more difficult for Aruba. Inflation In graph 2 one can note the inflation perspective in Aruba compared to other countries. These projections indicate that inflation in Aruba will remain below the global average.

For the next few years, the Government of Aruba has outlined the following financial norms to achieve long-term responsible financial results by 2024: financial balance of +1.0% of GDP (=surplus) 2027: personnel expenditure of 10% of GDP 2031: debt quota of 70% of GDP 2040: debt quota of 50% of GDP

The financial balance for the next few years will be maintained at 1% surplus on the budget with the primary goal of reducing the country’s debt. Budget 2024 meets second consecutive financial surplus norm of +1.0% of GDP

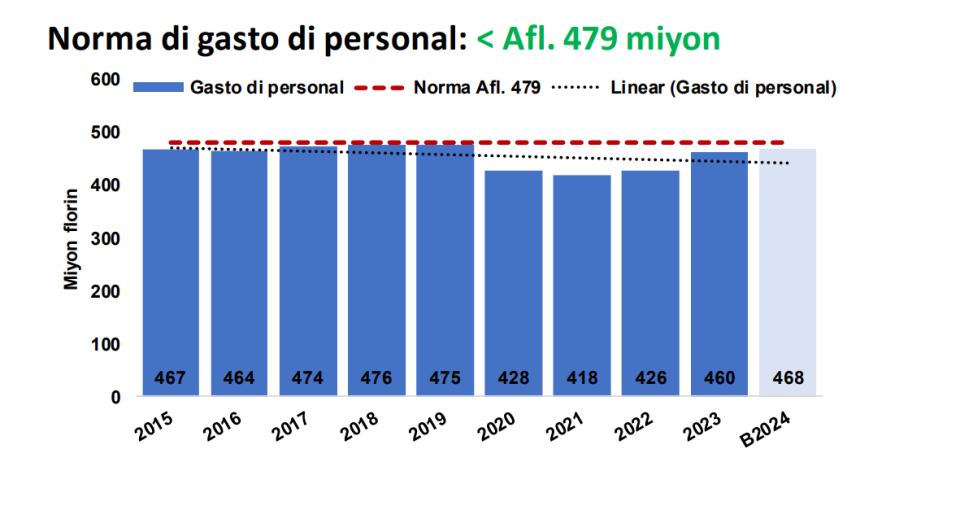

Staff expenditures Staff expenditures, which are one of the largest government expenditures, also meet a standard. In the 2024 Budget, personnel expenditures are kept below the 479 million guilders that are the current norm. The Government of Aruba is committed to ensuring that by 2027 the total expenditures of Government personnel, State High Schools, Department of Public Works and the subsidized institutes, remain below the 10% of GDP norm.

1 comment

[…] Source link […]